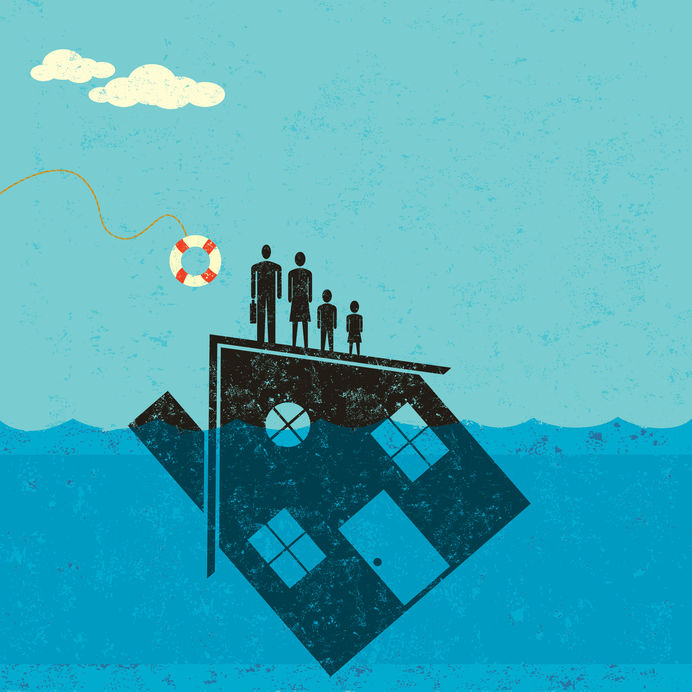

Yes. Filing for bankruptcy can be beneficial if your house is in foreclosure. When you are in foreclosure, bankruptcy can help you manage your debts and help you catch up on past due payment.

There are two different ways to file for bankruptcy. The first is a Chapter 7 bankruptcy proceeding. A Chapter 7 bankruptcy proceeding is the more simple type of bankruptcy proceeding. In a Chapter 7 bankruptcy proceeding, a trustee is appointed to your case. The trustee takes some of your assets and then distributes them to the creditors that have filed claims. However, the trustee does not take all of your assets, there is a list of exempt property that the trustee does not distribute. The purpose of this is for the person who filed for bankruptcy to be able to have just enough to start over without any debt. A Chapter 7 bankruptcy proceeding prohibits collection actions against the debtor or the debtor’s property, which is called an automatic stay. When the automatic stay is in effect, creditors cannot continue lawsuits or demand payments from the debtor. The automatic stay also prevents a creditor from collecting debts, prevents evictions, and prevents repossessions.

In a Chapter 13 bankruptcy proceeding, the debtor submits a reorganization plan. The reorganization plan protects the debtor’s property from being repossessed. The reorganization plan tells the court how you plan to pay back your debt. An individual cannot have more than $394,725 in credit card bills or personal loans and cannot have more than $1,184,200 in mortgages and car loans. A Chapter 13 bankruptcy proceeding suspends a foreclosure proceeding and payment of other debts.

Can a Bankruptcy stop a Foreclosure?

Yes. Both a Chapter 7 bankruptcy proceeding, and a Chapter 13 bankruptcy proceeding can help temporarily stop a foreclosure. In a Chapter 7 bankruptcy proceeding, an automatic stay prohibits judicial proceedings against a debtor that were filed prior to the automatic stay. Because the automatic stay stops the foreclosure proceeding, a debtor is able to make payments on the house that are past due. However, the debtor still needs to make regularly scheduled mortgage payments after the automatic stay is in effect, or the debtor would still be at risk to lose the house.

Additionally, a Chapter 13 bankruptcy proceeding allows a debtor to make overdue payments to creditors for three to five years. During this time, the debtor must also continue making regular mortgage payments and catch up on any overdue mortgage payments. However, if the debtor stops making any payments during the reorganization plan, then a creditor can foreclose on the home.