Is there a Grace Period for Rental Payments during the COVID-19 Pandemic?

A grace period is a predetermined period of time immediately following a payment due date during which a late fee

A grace period is a predetermined period of time immediately following a payment due date during which a late fee

EXECUTIVE SUMMARY: The CARES ACT passed by the U.S. Congress on Friday, March 27, 2020 and signed into law by

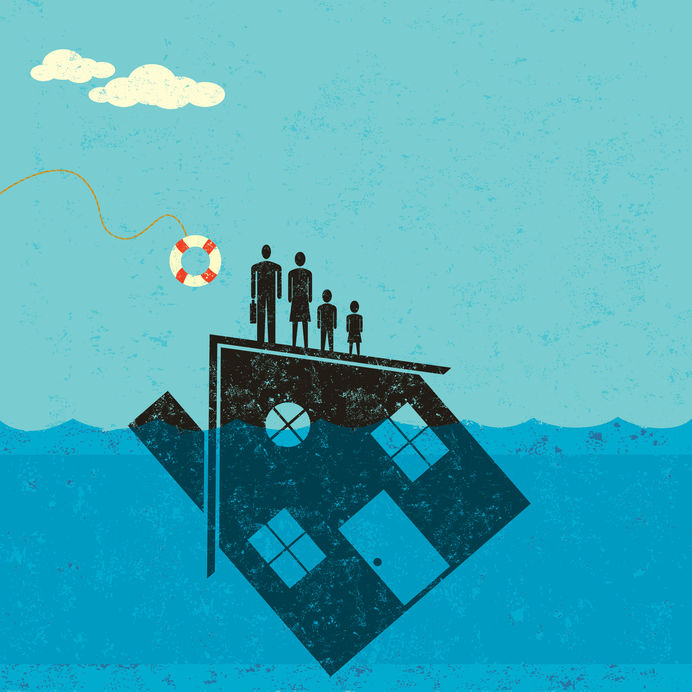

Last week Fannie Mae and Freddie Mac suspended evictions and foreclosures for families living in houses financed through one of their loans. This policy was now extended by the two banks to include renters as well, in the event when they are not able to pay rent due to the coronavirus outbreak.

The federal and state governments have offered a variety of aid or relief to individuals and small business owners related

When conflict between laws or orders issued from different levels of government exists, the law at the higher level will typically govern unless that law or declaration is found to be unconstitutional. For instance, when federal and state law is in conflict, the federal law will supersede, or preempt, the state law and take precedence due to the supremacy clause of the United States Constitution.

Saving money on taxes is a great incentive to consider leasing your assets to a corporation. It is common for shareholders of corporations to lease real estate, equipment, and other property, such as vehicles, to the corporation, either directly or indirectly.

The operating agreement for an LLC is imperative because it can outline all the company’s procedural and financial decisions. Although an operating agreement is not required in many states, most limited liability owners create an operating agreement as soon as they create their company. The operating agreement protects owners and sets out anything that has been orally agreed on.

When most people think of foreclosures, the two parties instantly discussed are the owner that is being foreclosed upon and the bank that is doing the foreclosing. However, when the property is headed to the auction block there is another party that comes into the picture: third party purchasers. When the bank lists the property at the foreclosure auction, a third-party purchaser often decides to buy the property if he or she believes it is a good deal. Third-party purchaser can take strategic risks and make money through legal loopholes.

If you believe foreclosure is imminent and need assistance moving forward, please do not hesitate to contact one of our knowledgeable attorneys at EPGD Business Law.

The COVID-19 Virus (“Coronavirus”) is presenting challenges for businesses in a multitude of areas. One particularly concerning prospect is an employee being exposed to the virus and in turn contaminating the rest of the business. While employers may want to ask their employees questions about their health to evaluate the risk of exposure, employers need to be aware of the various laws surrounding this sensitive topic.

Con estos libros guía, aprenderás cómo iniciar tu negocio de la manera correcta y proteger tu marca. Descarga las guías gratuitas ahora y da el primer paso hacia el logro de tus metas.