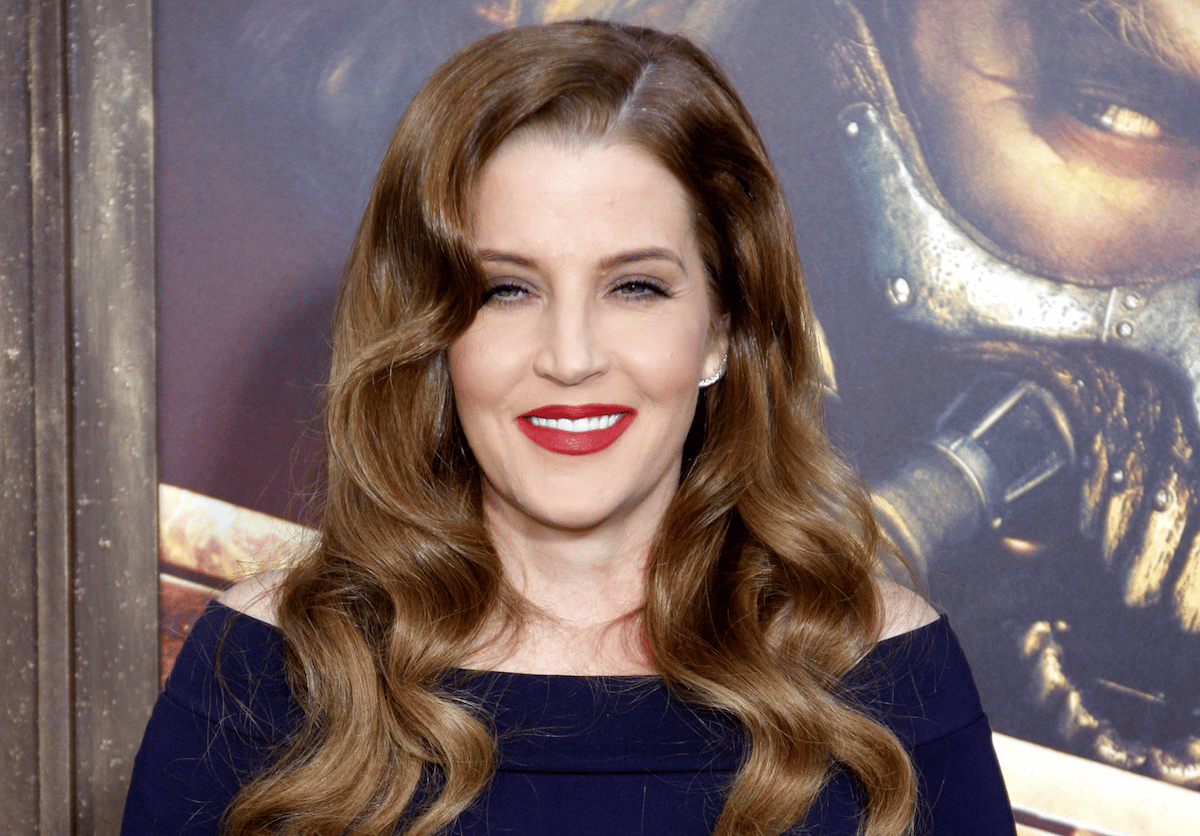

Lisa Marie Presley, the daughter of the legendary Elvis Presley, recently passed away at the age of 54. This news has sent shockwaves throughout the music industry and has left many people wondering what will happen to her estate. Lisa Marie Presley was not only the daughter of Elvis Presley but also an accomplished singer and songwriter in her own right, releasing several albums that showcased her talents and cemented her place in music history.

Her passing has now raised questions about the fate of her estate. Many people are curious to know who will inherit her assets, including her music catalog and any other assets she may have had. Another aspect of Lisa Marie Presley’s estate that has garnered attention is Graceland, the former home of her father. This iconic property is one of the most famous homes in the world and is a major tourist destination, attracting thousands of visitors each year. Lisa Marie’s mother, Priscilla Presley, has been an active participant in the management of Graceland and has been involved in the estate for many years. There have been reports that she has contested the validity of Lisa’s trust.

In general, a person may challenge the distribution of assets in an estate if they believe that the distribution is not in accordance with the decedent’s wishes or if they believe that the estate is being mismanaged. Additionally, disputes may arise over the validity of a will, or if the executor of the estate is not acting in the best interest of the beneficiaries. If there is a legitimate basis for a challenge, it may be brought to court for resolution.

Recently, reports have mentioned that Priscilla has filed a legal challenge against the validity of her daughter’s 2016 amendment to her living trust. The amendment removed Priscilla and a former business manager as trustees and added Lisa Marie’s two oldest children, Riley and Benjamin Keough. However, since Benjamin Keough has passed away, only Riley remains as a trustee. Priscilla’s court filing alleges that there are several issues with the amendment, including a failure to notify Priscilla of the removal and a lack of a witness or notarization.

The requirements for notification when removing a trustee may vary based on the specific terms of the trust document and the laws of the jurisdiction in which the trust is established. If the trust document requires notification and the proper procedures were not followed, this could potentially be a basis for challenging the validity of the change. A lack of witness or notarization could potentially affect the validity of a legal document as well. In most states, a will must be signed by witnesses to be considered legally valid. If there is a lack of witnesses or notarization, it can be an issue in probate court, particularly if there are disputes over the authenticity of the document.

It remains to be seen what will happen with Lisa Marie Presley’s estate and how her assets will be distributed. Given the recent legal challenge by Priscilla Presley, it could take some time before the matter is resolved. Ultimately, the resolution of the legal challenge and the distribution of Lisa Marie Presley’s estate will determine the future of her music catalog and the iconic Graceland property. Regardless of the outcome, it is clear that the legacy of both Lisa Marie and her father, Elvis Presley, will continue to live on. Their impact on the music industry and their influence on popular culture will not be forgotten.

In conclusion, the passing of Lisa Marie Presley has brought to light the complexities that can arise when it comes to distributing assets in an estate. It is important to consult with an estate planning attorney to ensure that all necessary steps are taken to protect one’s assets and ensure that the distribution of their estate is carried out smoothly. This can include ensuring that the estate plan is updated regularly, that all necessary legal documents are in place, and that the terms of the estate plan are clearly understood by all parties involved.

Estate planning can be a complex process, but it is a critical step in ensuring that one’s assets are protected and that their wishes are respected after they pass away. The legal challenge to the validity of her living trust amendment serves as a reminder of the importance of having a well-crafted estate plan in place, which can help to minimize the risk of disputes and ensure that one’s assets are distributed in accordance with their wishes.