What are Exemptions Deductions?

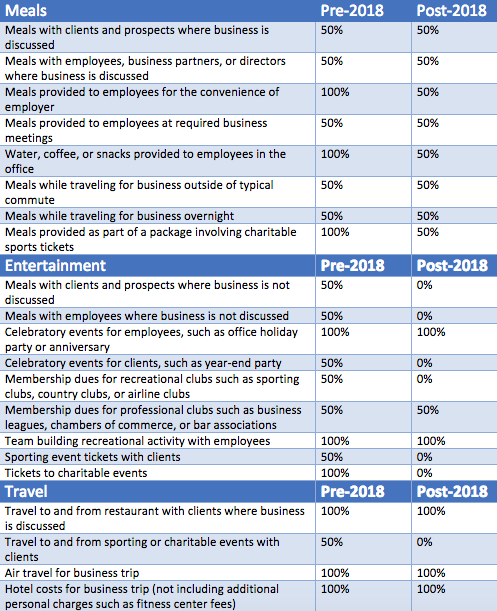

The Tax Cuts and Jobs Act passed in 2017, and effective in 2018, provides businesses with a reduced tax rate, but also significantly alters the tax deductions businesses can claim. Some major categories of tax deductions that have been adjusted are meals, entertainment, and travel for either employees or clients. The changes are provided in the chart below:

TCJA repealed the entertainment deduction as a business expense entirely.

The IRS recently issued additional guidance regarding the new meals and entertainment deductions:

- 1. Deductions for any item with respect to an activity that is generally considered to be entertainment, amusement or recreation are not permitted.

- 2. The Act did not change the definition of “entertainment”, hence, the regulations in existence prior to the Act are still valid. A subjective test is used to determine whether an activity is of a type generally considered to be entertainment.

- 3. Although the Act did not address when meal expenses might constitute entertainment expenses, the legislative history indicates that 50% of the cost of food and beverages may still be deducted if they are incurred in connection with the operation of a trade or business. Regulations will be issued to clarify when meal expenses constitute entertainment expenses and when they constitute deductible meal expenses.

- 4. Taxpayers may deduct 50% of business meal expenses if all the following requirements are satisfied:

-

- a) The expense is an ordinary and necessary business expense and is paid or incurred in carrying on a trade or business;

-

- b) The expense is not lavish or extravagant;

-

- c) The taxpayer, or an employee of the taxpayer, is present at the time the food and beverages are provided;

-

- d) The food and beverages are provided to a current or potential business customer, client, consultant or similar business contact;

-

- e) If the food and beverages are provided during an entertainment event, the cost of food and beverages must have been paid for separately from the cost of the entertainment, or the cost of the food and beverages must have been stated separately in any contract, invoice or receipt; and

- f) The entertainment expense disallowance is not circumvented by inflating the cost of food and beverages.

The IRS has provided examples illustrating the requirement in paragraph (e):

Example One: Taxpayer takes a client to a baseball game. The cost of the tickets to the game is an entertainment expense that cannot be deducted. During the course of the game, the taxpayer purchases food and beverages for him/herself and the client. Fifty percent (50%) of the cost of the food and beverages is deductible because the cost was incurred separately from the entertainment cost.

Example Two: Taxpayer takes a client to a baseball game. The seats are in a suite and the tickets include food and beverages. None of the expense is deductible. The football game is an entertainment expense. Since the cost of the food is not separate from the cost of the tickets, there can be no food and beverage deduction. If the tickets, however, separate the cost of admission from the cost of the food and beverages, the cost of the food and beverages is a 50% deductible expense.